Navigating the Future: Blockchains Impact on Accounting and Auditing Practices

For now, we observe that, with the blockchain landscape changing daily, and ideas and research needing to reach the target audience faster than the traditional journal route allows, researchers are turning to SSRN to share their tentative findings (Holub and Johnson, 2017). We also observe that Australian scholarship is now leading the blockchain peculiar features of single entry system in the context of bookkeeping research in accounting, as more papers were published in journals included in the ABDC ranking compared to the ABS ranking. Moreover, Australian journals such as the Australian Accounting Review and Meditari Accounting Research are among the top tiers of those who welcome such research. It is also important to understand all the advantages and disadvantages of joining a public or a private blockchain (O’Leary, 2017).

On the other hand, Nyumbayire (2017) points to environmental sustainability as an issue, explaining that the algorithms that run blockchain require a great deal of electricity. Moreover, as the technology grows, the algorithms become more complicated, and more time and energy are required to validate transactions. We argue that in the future, researchers should investigate the sustainability and environmental issues related to blockchain in more detail. Moreover, Kokina et al. (2017) note that the scalability of blockchain is an issue from a technical perspective, as blockchain is computationally intensive and requires a lot of energy. This raises sustainability questions and may not be an issue that gets resolved until renewable energy accounts for most of our energy production (Coyne and McMickle, 2017).

1 The changing role of accountants

It should therefore be unsurprising to consider that this revolution will start to change the nature of accounting and, in turn, the work of its practitioners and theorists (e.g. Yermack, 2017; Schmitz and Leoni, 2019; Yu et al., 2018). This includes integrating data from a prior period as those data become available (accounting for subsequent events or adjusting for under/over applied overhead are examples). The ability for a double-entry accounting system to make such adjustments is crucial to its utility in the modern world. Blockchain negates this ability, making substantiation less beneficial than promoters claim.

1 The research questions

Comprehensive work by regulators and policymakers may help implement and spread these technological innovations further, opening new sources of financing for companies. There is also a need to work on legal and taxation policies for tokens, bitcoins and other cryptocurrencies so that they become valuable tools and stable assets in capital markets. With the improved regulatory framework, we also propose that in the future governments may develop national cryptocurrencies, e.g. crypto-euros or crypto dollars, that will be easier and faster to use compared to existing currencies. A well-developed regulatory framework may help tokens become a legitimate means of exchange in ecosystems that will start growing in the future. Further work is required from accounting bodies to accept new types of digital assets and develop standards that will solve the issues related to their recognition, measurement and disclosure.

Navigating the Future: Blockchain’s Impact on Accounting and Auditing Practices

How cryptoassets and cryptocurrencies should be taxed is also open to question (Ram, 2018). Once clarified, researchers will be able to study the taxation policies applicable to this new class of assets in detail. One related research question for the future involves whether blockchain-based instant tax allocation helps to decrease the cost of tax compliance for costing methods and techniques companies or not (Karajovic et al., 2019). As the role of external contexts and legal frameworks is highly important to blockchain development (Allen et al., 2020; Stratopoulos and Calderon, 2018), researchers may study the differences in blockchain implementation in environments that are (and are not) “crypto-friendly”.

- Due to distributed ledger technology, blockchain technology eliminates the need for entering accounting information into multiple databases and potentially removes the need for auditors to reconcile disparate ledgers.

- Routine accounting data would be recorded permanently with a timestamp, preventing it from being altered ex-post, which Alles (2018) argues would further ensure the reliability of current accounting information systems.

- The authors’ structured literature review uniquely identifies critical research topics for developing future research directions related to blockchain in accounting.

- In machine learning, there are many different text mining techniques, each designed to suit different types of data and different end purposes (see Wanner et al., 2014 for a comprehensive review).

- We argue that in the future, researchers should investigate the sustainability and environmental issues related to blockchain in more detail.

- It is also important to understand all the advantages and disadvantages of joining a public or a private blockchain (O’Leary, 2017).

A large amount of attention and capital currently is being allocated toward virtually anything related to blockchain technology. It is important to examine blockchain first by getting a better understanding of the technology and then examining the accounting and auditing implications. The key feature in blockchain is that anything that is stored on the blockchain is there forever, the information is immutable and cannot be erased. The information that is stored on the blockchain offers us a level of transparency that has not previously been seen. It means that if Person A owns something and transfers the ownership or value of it to Person B there will always be a record in the blockchain that Person A owned it.

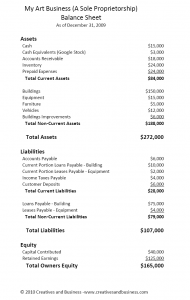

Has more than 20 years of experience in internal audit and accountingincluding financial, operational, compliance, and information andtechnology audit. He has experience across many sectors includinghealthcare, manufacturing, government and trading enterprises. (2017), “Toward blockchain-based accounting and assurance”, Journal of Information Systems, Vol. Lev and Gu (2016) argue that blockchain may reduce information asymmetry and lead to more effective decision-making. Anyone could aggregate the firm’s transactions into the form of an income statement and balance sheet at any time, and they would no longer need to rely on quarterly financial statements prepared by the firm. As mentioned in the methodology, we checked the validity and reliability of the topic results using citation analysis (Dumay et al., 2018).

Research shows LDA to be a relevant and useful tool for working with both big and small literature corpora (e.g. Li, 2010; Asmussen and Møller, 2019; El-Haj et al., 2019). Asmussen and Møller (2019, p. 16) highlight that applying LDA to even small sets of papers provides “greater reliability than competing exploratory review methods, as the code can be rerun on the same papers, which will provide identical results”. For these reasons and more, the LDA method is currently one of the most commonly employed topic identification methods that does not simply rely on a static word frequency measure (Blei et al., 2003). Moreover, El-Haj et al. (2019, p. 292) recommend employing machine learning methods and high-quality manual analysis in conjunction as they “represent complementary approaches to analyzing financial discourse”. We followed this advice, applying a hybrid approach that comprised LDA analysis, citation analysis and a manual review.

For example, Dumay and Cai (2014) and Jones and Alam (2019) argue that citation impact factors are increasingly important because they identify the most influential articles. Highly cited articles represent a “corpus what is business equity of scholarly literature” that can help “develop insights, critical reflections, future research paths and research questions” (Massaro et al., 2016, p. 767). To conduct a citation analysis, we use citation counts based on Google Scholar data, based on queries employing Harzing’s Publish or Perish software as of 5 March 2021.