Net Present Value NPV Calculator Formula Example Explanation

You simply have to provide the calculator with each cash flow, the time period in which each cash flow occurs, and the discount rate that you want to use to discount the future cash flows to the present. Working out the net present value of a project or investment starts simply by adding together all the present values of the relevant future cash flows. Then you deduct the total amount of investment – cash outflows – to give you the Net Present Value. The discounted cash flows are inclusive of the cash inflows and cash outflows; hence, the usefulness of the metric in capital budgeting. One limitation of NPV is that it relies on accurate cash flow projections, which can be difficult to predict.

- Then you deduct the total amount of investment – cash outflows – to give you the Net Present Value.

- For this reason, payback periods calculated for longer-term investments have a greater potential for inaccuracy.

- The present value (PV) of a stream of cash flows refers to the value of the future cash flows as of the current date.

- The full calculation of the present value is equal to the present value of all 60 future cash flows, minus the $1 million investment.

- Evaluate the role of cost of capital in decision-making and explore the trade-offs between risk and return.

Net Present Value (NPV): What It Means and Steps to Calculate It

Third, the discount rate used to discount future cash flows to the present can be increased or decreased to adjust for the riskiness of the project’s cash flows. Overall, NPV is the preferred method of analysis for measuring the potential returns of an investment. It considers essential factors such as inflation, tax rates, and the present value of future cash flows. Most businesses use the NPV calculation to evaluate potential investments, projects, or products. The calculation helps you understand what the future cash flows of a project are worth in today’s dollars.

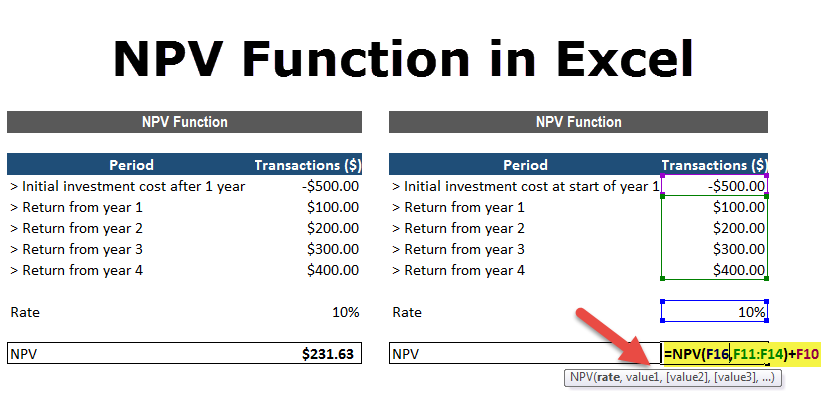

Calculating NVP

Thus, a net present value calculator can not only be used to judge a good investment from a poor one, it can also be used to compare two good investments to see which one is better. All else equal, the equipment or project with the highest value is the best investment. By considering the time value of money and the magnitude and timing of cash flows, NPV provides valuable insights for resource allocation and investment prioritization. what is a three-way match in accounts payable gep glossary The time value of money is a fundamental concept in finance, which suggests that a dollar received today is worth more than a dollar received in the future. The NPV formula doesn’t evaluate a project’s return on investment (ROI), a key consideration for anyone with finite capital. Though the NPV formula estimates how much value a project will produce, it doesn’t show if it’s an efficient use of your investment dollars.

Using Cash Outflows to Determine NVP

A higher discount rate will result in a lower NPV, while a lower discount rate will result in a higher NPV. This is because a higher discount rate reflects a higher opportunity cost of investing in the project, while a lower discount rate reflects a lower opportunity cost. While NPV offers numerous benefits, it is essential to recognize its limitations, such as its dependence on accurate cash flow projections and sensitivity to discount rate changes. It is the discount rate at which the NPV of an investment or project equals zero. The reliability of NPV calculations is highly dependent on the accuracy of cash flow projections.

Calculate Present Value of Each Cash Flow

In accounting, this predictive equation is known as the ‘present value of future cash flow’. This is the foundation of working out the overall Net Present Value of a project or investment. The initial investment of the project in Year 0 amounts to $100m, while the cash flows generated by the project will begin at $20m in Year 1 and increase by $5m each year until Year 5. As I mentioned earlier, this is an investment calculation that is used by all types of investors, not just traditional Wall Street investors.

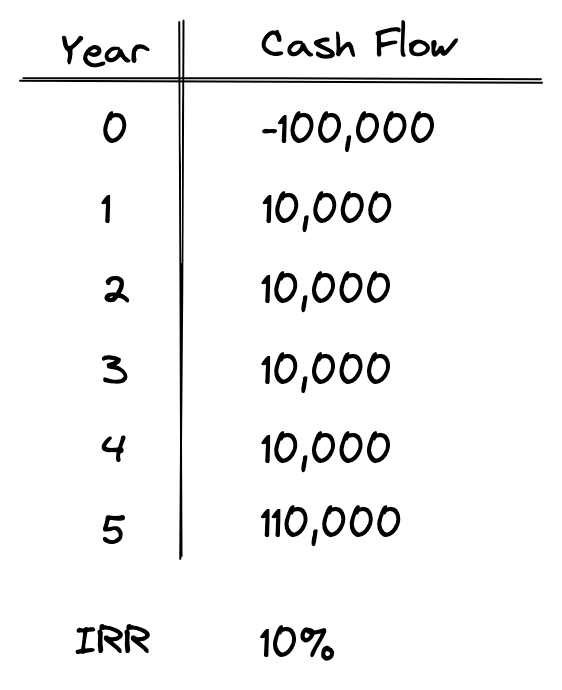

In studying “Investment Decisions” for the CMA, you should learn to evaluate various types of investments by analyzing cash flows, risks, and returns to make sound financial decisions. Understand capital budgeting techniques, including net present value (NPV), internal rate of return (IRR), and payback period, and how to apply them to assess project viability. Analyze the impact of investment decisions on a company’s financial health and strategic goals. Evaluate the role of cost of capital in decision-making and explore the trade-offs between risk and return. Additionally, gain proficiency in performing sensitivity analyses to assess how changes in assumptions affect investment outcomes, preparing you to make informed, data-driven decisions.

Proposal X has the highest net present value but is not the most desirable investment. The present value indexes show proposal Y as the most desirable investment because it promises to generate 1.07 present value for each dollar invested, which is the highest among three alternatives. Let’s take a few examples to illustrate how the net present value method is employed to analyze investment proposals. Because the NPV is positive, Sam’s Sporting Goods should purchase the embroidery machine. The value of the firm will increase by $2,835.63 as a result of accepting the project.

Additionally, a terminal value is calculated at the end of the forecast period. Each of the cash flows in the forecast and terminal value is then discounted back to the present using a hurdle rate of the firm’s weighted average cost of capital (WACC). The payback period is the time required for an investment or project to recoup its initial costs.

Toyota wants to set up one new plant for expansion of current business, so they want to check the feasibility of the project. If, on the other hand, an investor could earn 8% with no risk over the next year, then the offer of $105 in a year would not suffice. Good cash flow management supports both operational needs and strategic initiatives. By understanding and leveraging these concepts, you can make informed decisions about where to allocate your resources for maximum returns. The discount rate should reflect the amount you would invest in a risk-free investment, such as a government bond. Whether considering a new business venture or evaluating an existing project, the NPV calculation can help determine if it’s worth pursuing.