How much to charge for bookkeeping

Content

She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. We typically start with a free 30-minute consultation, during which we’ll take the time to listen and understand your business, and goals before putting together a plan that works for you. If you want more help, we have a guide on how to price your services here. You might also want to check out this podcast episode where I discussed how to include client questions & support in a subscription plan.

- Moreover, businesses applying for COVID-19 and other financial assistance programs have to ensure that their records are sound enough to meet all official requirements, including audit tests and reviews.

- To illustrate what a medium client looks like, I’ll be using a law firm I do bookkeeping for that generates about $800k in revenue a year.

- We believe that startups deserve to know what their monthly bookkeeping costs will be, which is why we offer set, recurring packages.

- According to a survey by ZipRecruiter, the average national rate for a self-employed bookkeeper is $34.64 per hour, but these rates vary from one state to the next.

The costs a small business or nonprofit incurs for bookkeeping will depend upon many variables. In addition to these basic bookkeeping activities, your costs will be impacted by how your accounting systems, policies and procedures, and reporting needs are set up and administered. Income for online bookkeepers and freelance bookkeepers may vary depending on several factors, such as experience, skills, location, client base, and the types of services that they offer. However, freelance bookkeepers may have more control over their pricing and may charge higher rates because of their specialized skills or expertise.

Our Accounting Services

Are you ready to focus your energy on growing your business, not on keeping your books? We offer a refreshingly forward approach to accounting and bookkeeping for small business. With dedicated experts and best-in-class tools, our team of bookkeepers will keep your finances up-to-date and accurate so you can make smart decisions about your business.

- Recent reports estimate that small- and mid-sized businesses spend roughly 5% of their time on administrative tasks like bookkeeping and accounting.

- We are dedicated to providing best-in-class services for your business today, tomorrow, and into the future.

- Will you provide services once or on a monthly, quarterly, or annual basis?

- Get the app list, reasons why they rock and my top tips and tricks.Plus, you’ll get my weekly Top 5 email curating helpful, innovative content for your modern firm.

- With cash-based bookkeeping, the client’s revenue is tracked as it is received, and expenses are documented as they are paid.

Working a maximum of five hours per month on this particular client’s books, and charging $250 a month, I’m making right around $50 an hour, which is in the ballpark of where I want to be. To illustrate the cost efficiency of a part-time bookkeeper, consider the following example. GrowthForce accounting services provided through an alliance with SK CPA, PLLC. They focus on recording the financial transactions of a business through maintaining records, tracking transactions, and creating financial reports. Whatever structure and pricing you go with, make sure to lay it all out on the table for current and prospective clients.

Basic Bookkeeping Costs Per Month and Year

A large corporation may place a higher value on bookkeeping services that help them stay compliant with government regulations and audits. They may be willing to pay a higher rate for bookkeepers with specialized training or certification in auditing and accounting. It’s normal for startup founders to want to understand how their startup’s bookkeeping services are priced. And it’s a really good question because there are several variables that make startup accounting more or less expensive.

But what you might not realize is that putting bookkeeping off can cost exponentially more time. Let’s compare the cost of an in-house bookkeeper vs. an outsourced bookkeeper. But keep in mind that these numbers are industry averages, and are subject to variables, like your location. With the idea of hiring a full-time accountant on your roster now put to bed, let’s consider what kind of bookkeeping you may need. Hiring a proficient bookkeeper and thoroughly reviewing the bookkeeping price packages can help your organization in a variety of ways, including those mentioned below. Flat rate pricing is easy to standardize with a few pricing packages, which may look like a small, medium or large package based on the size of the business and your client’s needs.

How is Bookkeeping Different than Accounting?

If you want your business to save time and money then, yes, you should consider hiring a bookkeeping service. A bookkeeping service can help you stay organized and on top of your finances. Bookkeeper360 is best for businesses that occasionally need bookkeeping services as well as those that want integrations with third-party tools. Botkeeper is best for accounting firms that want to scale by automating bookkeeping tasks. In addition to their expert bookkeeping and tax advice, Xendoo plans integrate with accounting software like Xero and QuickBooks to simplify your books alongside access to mobile apps and profit and loss statements.

If you’re growing, the outsourced bookkeeping service should be able to help you scale by adding full service accounting when you are ready for it. On average, small business owners can expect to pay between $ per hour for bookkeeping services, depending upon many factors. And, based on the services you require, you’ll probably need at least 5-15 hours per month worth of bookkeeping. So, if you do the math, most small- and mid-sized businesses can expect to pay between $250 – $1,500 per month. What is the difference between small, medium, and large client accounts for bookkeepers? Let’s break down the different sizes to their revenue, employee numbers and other key metrics.

Factors Influencing Bookkeeper Rates

If you live in a small town or rural area, you will likely need to charge less for your bookkeeping services than someone in a major city, as living costs are typically lower in smaller towns and rural areas. However, location plays less of a role now than it used to because everything is virtual, and you can serve small business clients worldwide. A lot of those systems actually have built in either integrations or ways for us to handle them automatically, so that gets some of the work off the accountant’s plate. This means that many transactions can be automatically and cleanly dropped into QuickBooks, it’s actually coming in cleanly into QuickBooks.

This means you will set one price for all your bookkeeping services. This option is ideal if you have a good understanding of the scope of work involved and you are confident that you can complete the job in a timely manner. The problem with hourly billing is that it can lead to unpredictable fees for your client, and there is no incentive for you, as the bookkeeper, to complete your work more efficiently. It is best for this pricing structure to implement software for accountants that track time to ensure your time tracking is efficient and accurate.

Value-based pricing

It takes a bit more strategy & thought than the billable hour as well as some basic education in price theory. In basic bookkeeping and accounting, not all hours are created equal. If you don’t have the budget to hire someone in-house but want bookkeeping experts with quality control, outsourced accounting firms can provide some—or all—of your needs. One of the main differences between firms and freelancers https://www.bookstime.com/pricing is that the outsourced firms have likely already checked into their employees, providing you with a level of quality assurance. Because they are responsible for employing the bookkeeper, they can also provide continuity of services should a bookkeeper leave. Outsourced firms might also offer other services—like accounting or HR—allowing you to take care of all your outsourcing needs with one company.

What is included in bookkeeping services?

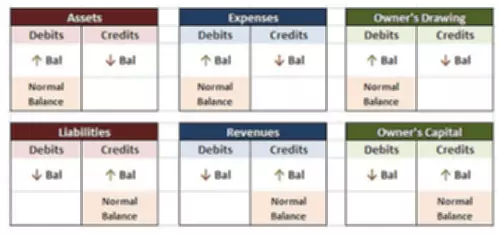

Bookkeeping focuses on recording and organizing financial data, including tasks such as invoicing, billing, payroll and reconciling transactions. Accounting is the interpretation and presentation of that financial data, including aspects such as tax returns, auditing and analyzing performance.

To avoid clients not paying their bills after work has been completed, it is important to move toward expecting some form of payment before the job is done, such as a deposit or retainer. By taking the time to research and consider all of these factors, you can determine how much to charge and adjust as needed. You must also look at what makes you different or your competitive advantage because you may be https://www.bookstime.com/ able to charge more if you can show your prospective clients that you provide more value than your competitors. Payments come in electronically, and when they come in, I apply it to the patient’s balance. I’m never in their physical office, so if someone pays in cash, the office has a system to make a cash deposit to their bank and then record it within the system so I know that it was taken care of.

I’m in charge of sending invoices out to their patients, so I look in the system how much we are supposed to be charging them. For example, the appointment may have cost $300, the insurance covered $200 of the charge, which leaves $100 as the patient’s responsibility. The thing that takes the most time with this client is the invoicing. They have a system outside of QuickBooks that is HIPPA compliant, which are the rules in the United States that you need to follow if you keep any medical information about your patients.

How To Start A Bookkeeping Business (2023 Guide) – Forbes

How To Start A Bookkeeping Business (2023 Guide).

Posted: Wed, 04 Jan 2023 08:00:00 GMT [source]